What You Need to Know About ‘Brand Equity’ — and Why Accountants Are the Problem

Marketing and accounting people don’t talk much. And they sure as hell don’t party well together. Let’s face it, they’re from different planets. But, doggone it, they need each other. That’s the case I want to make today.

Why? Because accountants can make the marketing profession look really, really good — and rich — if they would only more formally recognize the monetary value marketers create as the result of, the culmination of, everything they do — which is build brands.

That’s right, we’re talking here about what branding means in terms of money. Not warm fuzzies. Not how your favorite brand makes you feel. Not its deep meaning, nor the sense of belonging it gives you. Strictly bucks, baby! Yes, we’re talking about how brands — which marketing people create and build — do this one big thing: make people rich.

Maybe you’ve heard the term “brand equity”? Here’s one definition, from Investopedia:

“Brand equity refers to a value premium that a company generates from a product with a recognizable name when compared to a generic equivalent. Companies can create brand equity for their products by making them memorable, easily recognizable, and superior in quality and reliability.”

The question I raise in the title above, how it is valued, is what I’m diving into in this post. That’s far from an exact science, as you might imagine, and even has some controversy surrounding it. Accountants look at brand equity as an intangible and largely don’t know what to do with it. There are no recognized standards for it yet in the accounting profession — and that bothers some people (including me).

I actually ran across a recent article in the CPA Journal (no, I don’t read it on a regular basis!). The authors take a crack at helping their fellow bean-counters better understand what it is: Marketers’ Methodologies for Valuing Brand Equity: Insights into Accounting for Intangible Assets. Here’s an excerpt:

“One of the controversies involving brands — a type of intangible asset commonly referred to as a component of ‘goodwill’ — is that, based on FASB standards, valuations occur only when net assets are purchased; goodwill is then recorded in the financial statements as the excess paid for the net assets over their fair market value. The accounting profession holds that goodwill is to be recorded only when a business is acquired. Internally generated goodwill, they say, even if it is worth billions in economic terms, is not to be recorded.”

More from the article:

“Marketers have wrestled for years with various methodologies to quantify brand equity. From a marketing perspective, brand equity is based on how customers perceive a company’s products relative to the competition.”

The authors also present various approaches to valuing brand equity that marketers use:

• Customer lifetime value (CLTV) refers to the net present value of expected future cash flows arising from the customer base.

• Brand consultancies, such as Interbrand and Kantar Millward Brown, have developed proprietary methods to quantify the role a brand plays in a customer’s purchase decision.

• Company experts identify the various drivers of a company’s profitability, then categorize and weight those drivers, in an assessment of the percentage of economic profit attributable to the brand.

The article ends with this conclusion — a possible way forward in the controversy surrounding brand equity valuation:

“Because protocols exist to value brand equity, accounting professionals could partner with marketing professionals to develop a brand valuation process. For example, the Marketing Accountability Standards Board has a project called ‘Brand Investment & Valuation’ to assess brand strength and validate a practical model for brand valuation.”

Kudos to these accountant authors! But one wonders how long the partnership they propose could take to bear fruit. Meantime, marketers need to keep up the pressure on these accountant dudes (and dudettes).

What Is This Thing Called “Goodwill”?

I don’t want to get too deep into the weeds here. But, in order to better understand brand equity, you need to understand a broader term used by accountants and investors. An article from the Corporate Financial Institute provides help in this regard. Here’s an excerpt from Goodwill: An intangible asset created when the purchase price is higher than the fair market value:

“In accounting, goodwill is an intangible asset. The concept of goodwill comes into play when a company looking to acquire another company is willing to pay a price significantly higher than the fair market value of the company’s net assets. The elements or factors that make up the intangible asset of goodwill are comprised of things such as a company’s good reputation, a solid (loyal) customer or client base, brand identity and recognition, an especially talented workforce, and proprietary technology. These things are, in fact, valuable assets of a company, however, they are not tangible (physical) assets, nor can their value be precisely quantified. Under US GAAP and IFRS Standards, goodwill is an intangible asset with an indefinite life, and thus does not need to be amortized. However, it needs to be evaluated for impairment yearly, and many companies choose to amortize goodwill over a 10-year period.” (My bold emphasis added there.)

That last sentence raises an important point: goodwill is often written down after what a company’s board — or the market — determines was a failed or flawed acquisition. There have been numerous, high-profile cases of such writedowns, by notable companies including Time Warner, PayPal, GE, Valeant, HP, and many others. And here’s a very big recent example: Verizon to Take $4.6B Writedown on Media Unit. (What part of that was for over-estimating the brand equity of AOL and Yahoo? Don’t get me started…)

While we’re on the subject of monumental writedowns, here’s a doozer of a list from one of my favorite tech analyst firms, CB Insights: Fools Rush In: 37 Of The Worst Corporate M&A Flops.

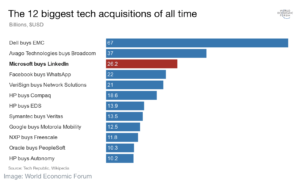

One recent high-profile acquisition in the tech industry (in 2016) was criticized by some: The Microsoft-LinkedIn Deal Proves We Overvalue Goodwill. Here’s what the author says contributes to such inflated goodwill:

“Zealous consultants and investment bankers will argue that the Goodwill Boom merely reflects the change in corporate strategies: American corporations manufacture far less than they used to. Companies aren’t buying other companies to add mills, factories, and other ‘real’ production facilities like we used to. Microsoft, for example, is buying LinkedIn for its brand, web site platform, and software — arguably far more ethereal assets. Not surprisingly, the $25 billion Microsoft is paying dwarfs LinkedIn’s $4 billion balance sheet.”

What part of this huge chunk of goodwill was for “brand”? No one’s saying — especially the accountants. Because they don’t f*cking know! They have no way of measuring that (which is the purpose of this strange rant of mine).

It remains to be seen if this Microsoft acquisition will suffer any writedowns. (Microsoft has become such a Wall Street darling since then.) But I’m betting there will be after reading this guy’s argument that the Redmond guys paid way too much: The Endgame for LinkedIn Is Coming (Medium).

Yet another darling on Wall Street (to say the least) is Amazon. You may remember that little acquisition it announced a while back, which lit up the media like it was nirvana itself arriving. Here’s a take from CNBC on that one, including how much of that deal was “goodwill” (including the elusive thing we call brand equity): Amazon’s soaring goodwill balance shows how Whole Foods buy was a long-term bet. An excerpt:

“Goodwill — the amount Amazon paid for beyond what’s valued on Whole Foods’ balance sheet — accounted for $9 billion, or roughly 70 percent, of the $13 billion acquisition price, according to Amazon’s annual report disclosed after the acquisition was announced. That means 70 percent of the cost was for things that are hard to measure, like Whole Foods’ potential for future growth, while only 30 percent was spent on buying actual assets, like existing stores or business relationships.”

What part was for the perceived equity of the Whole Foods brand? Doesn’t say. But you can bet Jeff Bozo — I mean, Bezos — and team had a number in their collective head. Even if their accountants didn’t.

For more on the topic of goodwill writedowns, here’s a piece from The Economist about how investors should view them: Disputes over goodwill can seem arcane. Their outcome matters. (But that’s another story.)

What’s the Future for Valuing Brand Equity?

Perhaps the best article I found in researching the topic of brand equity valuation was not a media article at all, but an Honors Scholar Thesis, if you can believe that (hey, I read a lot!): Valuation of Intangible Assets: Should Brand Equity Be Accounted for on the Balance Sheet? — it’s by Brooke Wasserman of the University of Connecticut.

His abstract lays out the case he makes in the paper:

“Brand valuation has become a commonplace tool for assessing company performance related to marketing and promotions of businesses. However, current U.S. and international accounting standards inhibit the recording of brands as assets on financial statements due to their intangible nature. This paper discusses the importance of understanding the contribution that brands provide to companies and outlines the potential options for reporting any associated intangible assets on financial statements. I suggest that additional reports should be included alongside currently required financial statements to record brand value separately from the other statements. The intangible brand assets should not be placed as a line item on the balance sheet due to the ambiguity involved in valuing them.”

I quote more from this paper here… the guy makes a good case:

“The marketing field has recognized the validity of branding for decades. But, only in recent years has the financial world, including Wall Street, begun to recognize the value of brands and study the long-term implications that strong brands can have on the financial markets. In turn, financial analysts have begun to perform more studies on stock performance as it relates to brand strength and are beginning to find ways to use the analyses to make smart investment decisions. As investors learn to utilize trends in brands, it will become necessary that accountants provide reports documenting and quantifying changes in brand value. It is the job of accountants to provide reliable and helpful reports for investors to get a transparent look at companies in order to make the best possible investment decisions. Brand value should be made apparent and obvious to the public so that they may make the best possible investment decisions for themselves. Right now, because accountants are not providing that level of detail with regard to brands, there is an obvious gap in financial statements and reports.”

The author points out a game-changer of sorts that happened in 2010:

“Financial markets have… disregarded branding as an indicator of investment value due to the intangible nature of brands. CFOs and analysts have a hard time monetizing them and, therefore, disregard them. However, Credit Suisse changed the game when it reported (in 2010), ‘Companies that focus on brand building consistently generate outsize, long-term growth, profitability, and return.’ Credit Suisse gave validity to the idea of brands having value and insinuated that the longevity associated with brand growth was a reason to trust and invest in a company. (That’s my bold emphasis added.) It gave investors a reason to start looking at brand equity and value to make investment decisions. With this shift in the economy, accountants must consider making a shift to their own policies regarding brands.”

The conclusion of the paper speaks to the real need for new standards:

“The accounting profession has traditionally ignored the issue of most intangible assets, treating them as an unsolved mystery. The existence of goodwill is acknowledged, but its composition is not dissected for true understanding. Accountants do not know what to do with intangible assets, many times just ignoring them, leaving them off balance sheets and income statements. (My emphasis added.) Such is the case with brands. Brands are viewed as unidentifiable and not easily quantifiable, so they are swept under the rug. But, changes in the business world and views on marketing have altered consumers’, corporations’, and investors’ views on the importance of brands. Accounting standards have failed to adjust, or at least make considerations, accordingly. It is time that accounting procedures align with the changing views and concerns of consumers, corporations, and investors. Accounting professionals, FASB, and IASB need to find a way to recognize brands within accounting standards.”

~~~~

So there you have it, marketers. Now you have a reason to harass every accountant you ever run into because of this crazy situation! These bean-counters need to get their profession into the 21st Century and start taking brand value seriously — because brands have clearly created, and will continue to create, an enormous amount of wealth. Time for a consistent way to measure that.

Happy branding!

[This post was first published on Medium, then on LinkedIn. Third time’s the charm!]